unified estate and gift tax credit 2021

The estate and gift taxes are based on a series of graduated rates that start at 18. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person.

Irs Announces Higher Estate And Gift Tax Limits For 2021

FAQ for General Business Credits.

. Help using the Georgia Tax Center. Find some of the more common questions dealing with basic estate tax issues. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death.

The unified credit against estate and gift tax in 2022 will be 12060000 up from 117. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. The unified gift and estate tax exemption and the generation-skipping transfer GST tax exemption are.

What Is the Unified Tax Credit Amount for 2021. The new york estate tax threshold is 592 million in 2021 and 611 million in 2022. The gift tax and the estate tax share the same exemption often referred to as the unified tax credit.

It increased to 1206. Learn about the COVID-19 relief provisions for Estate Gift. What Is the Unified Tax Credit Amount for 2022.

A key component of this exclusion is the basic exclusion amount BEA. A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases. The Housing Tax Credit Program allocates federal and state tax credits to owners of qualified rental properties who reserve all or a portion of their units for occupancy for low-income tenants.

Select tax account inquiry business tax credits. Highest tax rate for gifts or estates over the exemption amount Gift and estate exemption 2017 and prior years Gift and estate exemption 2022 expires in 2025 40. The maximum credit increases by 140 to 14440 for 2021.

Income Tax Letter Rulings Policies and Regulations. Married tax payers will also see a deduction increase. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from 117 million to.

After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. What Is the Unified Tax Credit Amount for 2021. Your child might be eligible to claim one on his or her tax return.

The estate tax is a tax on your right to transfer property at your death. Gift and estate taxes. Any tax due is determined after applying a credit based on an applicable exclusion amount.

For 2021 the estate and gift tax exemption stands at 117 million per person. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

What Is the Unified Tax Credit Amount for 2021. For 2021 that lifetime exemption amount is 117 million. The 117 million exception in 2021 is set to expire in 2025.

Understand the different types of trusts and what that means for your investments. As of 2021 you are able to give 15000 per year to any individual as a tax-exempt gift. If you die in 2022 after making such a taxable gift you will still be able to transfer assets worth 2 million through your will trust or otherwise estate tax-free.

The gift and estate tax exemptions were doubled. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Or of course you can use the unified tax credit to do a little bit of both.

The tax is then reduced by the available unified. 2021 and all proposals must be submitted by February 15th 2021. This is called the unified credit.

If you made other taxable gifts during life then the Unified Credit available at your. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

All people are qualified to take advantage of this tax perk from the Internal Revenue Service IRS. Kemp signs tax credit bills into law. The lifetime exemption was worth 117 million for tax year 2021.

HB 593 increases the standard deduction for single tax payers from 4600 to 5400. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. Or of course you can use the unified tax credit to do a little bit of both.

In general the gift tax and estate tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Both questions and proposals must be submitted by email to hfdrounddcagagov. How-to Videos and Instructions for Tax Credits.

It consists of an accounting of everything you own or have certain interests in at the date of death. Federal Tax Changes Need Help. Send an email for tax credit questions.

The unified tax credit is designed to decrease the tax bill of the individual or estate. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Then there is the exemption for gifts and estate taxes.

Married couples filing separately generally arent eligible for these credits. Tax Credit Forms You may also need. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

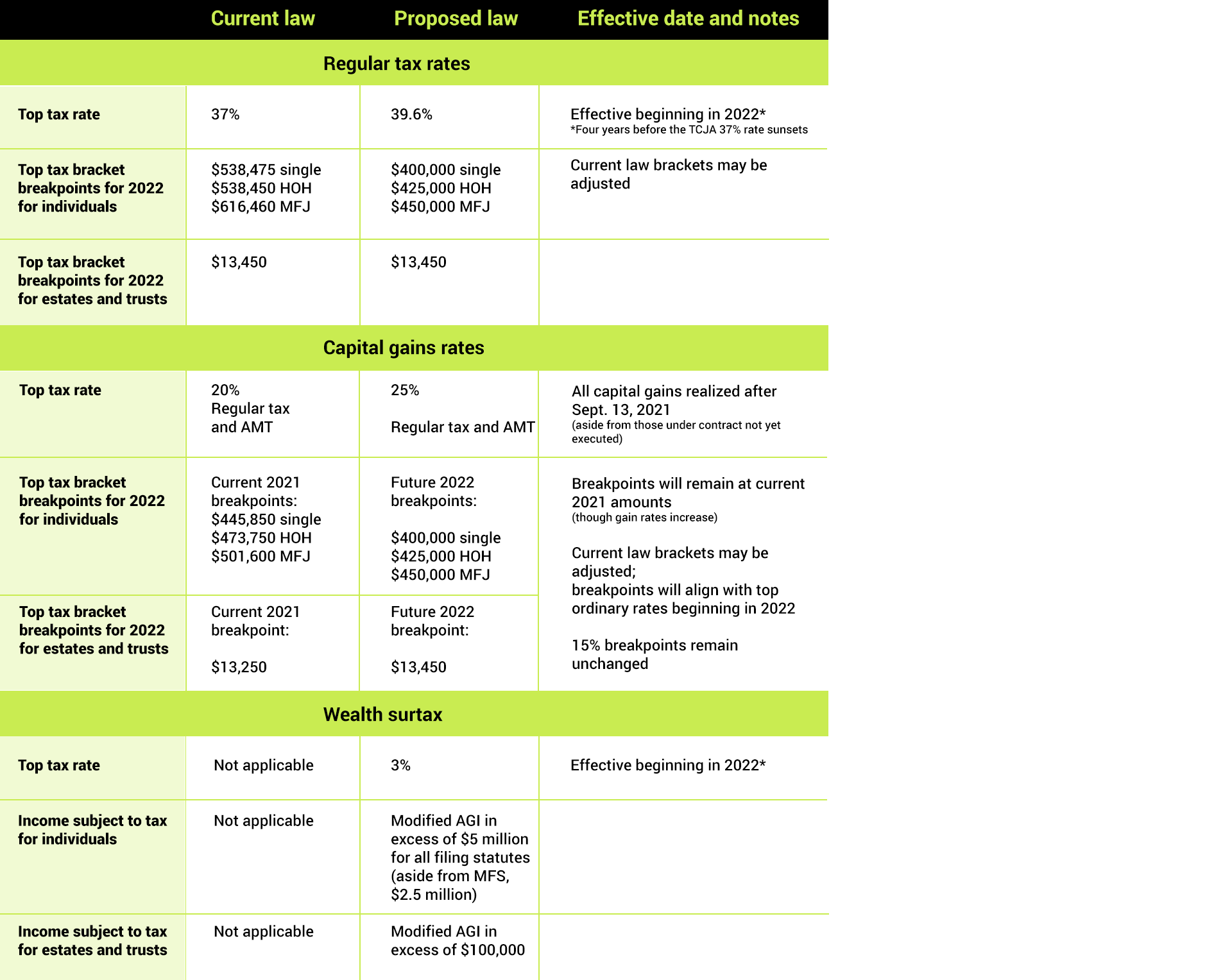

Gift and Estate Tax Exemptions The Unified Credit. In short the unified tax credit sets a dollar amount that each person is able to gift during their lifetime before any estate or gift taxes. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

Estate and Gift Taxes. Your available Unified Credit is effectively reduced from 1206 million to 12 million. With the passage of the Tax Cuts and Jobs Act.

Ad Inheritance and Estate Planning Guidance With Simple Pricing.

How Much Tax Do You Pay On Inheritance Legacy Design Strategies An Estate And Business Planning Law Firm

Historical Look At Estate And Gift Tax Rates Wolters Kluwer

House Introduces Major Tax Proposals Baker Tilly

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Portability Of A Spouse S Unused Exemption 1919ic

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Gift Tax Exclusion Essential Info Understand The Unified Credit

Do I Need To Pay Tax On My Inheritance In Arizona Phelps Laclair

Can Gifting Assets To Family Help Me Avoid Federal Estate Taxes

Estate Tax Planning Legacy Counsellors P C

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Portability Of A Spouse S Unused Exemption 1919ic

Gift Tax Exclusion Essential Info Understand The Unified Credit

:max_bytes(150000):strip_icc()/money_with_ribbon-5bfc328f46e0fb0083c1bfee.jpg)

:max_bytes(150000):strip_icc()/shutterstock_272486666.529.plan.1-b30dcd4a54c3468b8cb093fccb73668e.jpg)

/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)